5G and related technologies to drive industry digitalization

Industries have long discussed the need to digitalize in order to boost their resilience and production levels. The wake-up call, however, came with the COVID-19 pandemic, which brought to the fore the stark difference between industries that had the foresight to invest in digital infrastructure and the ones that relied on conventional methods.

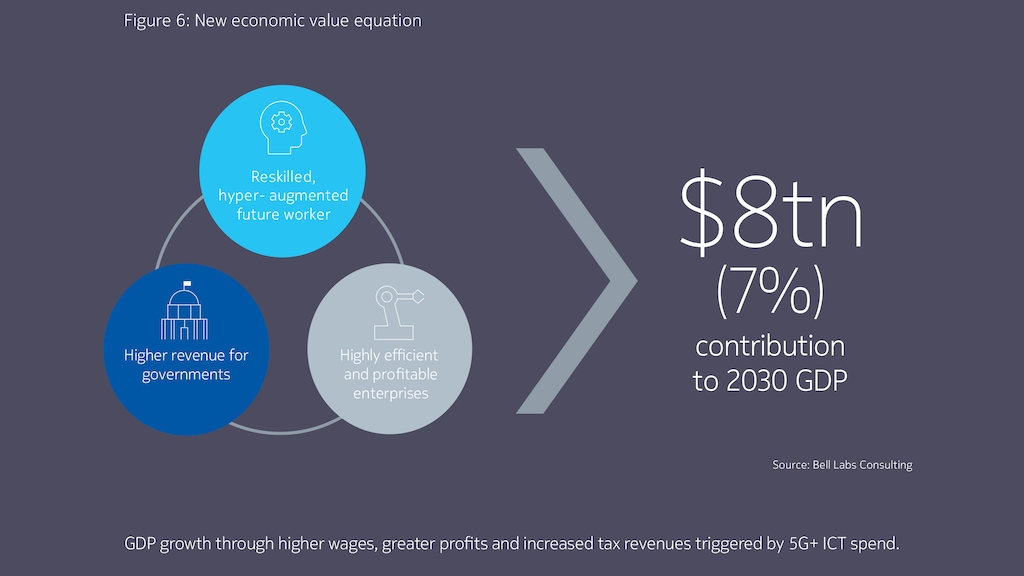

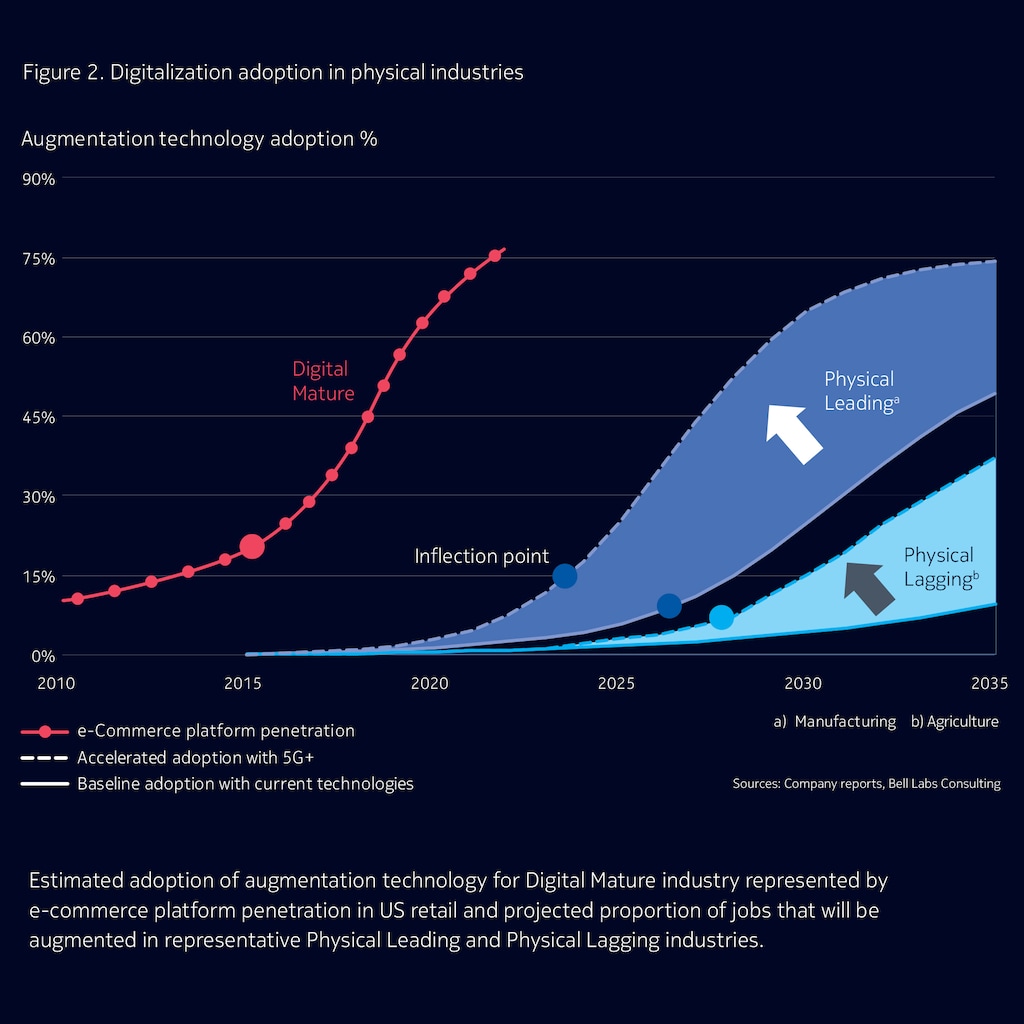

Bell Labs Consulting in its The big inversion whitepaper predicts that a new ecosystem of 5G and related technologies or “5G+” will equip industries with the necessary tools to kickstart the process of digitalization over the next decade. A tectonic shift in Information and Communication Technologies (ICTs) spending is on the anvil cutting across all sectors, from e-commerce and finance to manufacturing and agriculture. The impact of fusing 5G networks with cutting-edge solutions like augmented intelligence, edge cloud, private networks and as-a-service business models will not only give a fillip to productivity and safety, but it would also help contribute $8 trillion to global GDP by 2030.

Fuad Siddiqui, Executive Partner and Vice President, Bell Labs Consulting and member of Nokia Bell Labs Senior Leadership explains how a new crop of transformational technologies will pave the way for the industries of the future.

1. Could you elaborate on the concept of ‘5G+’ technologies?

Industries and enterprises are poised to make investments in a broad ecosystem of technologies that Bell Labs Consulting collectively terms “5G+”. It comprises not only the underlying foundational 5G networks, but also key technologies that will work hand in hand with 5G to digitalize every aspect of a company’s operations. This includes edge cloud infrastructure, augmented intelligence/ machine learning (AugI/ML), enterprise private networks, and advanced sensors and robotics. These technologies will act in concert and increasingly be accessible “as a service,” allowing instant access to the optimum tools and capabilities, from anywhere, at any time.

5G+ will establish the supply-side readiness required by industries in the post-COVID era to realize optimized productivity gains, strategic resilience, a more inclusive and purposeful future. These benefits to enterprises can translate into more and better jobs, increased enterprise profits and higher government revenues, resulting in sustained global GDP growth.

In summary, we predict that we are approaching a “big inversion” in ICT investment in physical and digital industries, driven by this emerging set of 5G+ technologies. This inversion will bring a level of proportional equity in ICT investment between the amount these industries invest in ICT and their respective contributions to overall global GDP and workforce employment. When this inversion is complete, industries will be equipped to create new economic and societal value.

2. Why have you chosen to call this trend the ‘Big Inversion’?

It is an inversion because increased ICT spend driven by 5G+ will flip the current 70:30 spending ratio between digital and physical industries to a 35:65 ratio in line with the relative GDP contribution of these two industries. It is big because this flip doubles the current enterprise ICT spend; more importantly, it is projected to contribute up to $8 trillion to the global economy in 2030.

The advent of 5G+ technologies offers physical industries the capability to intelligently augment and bridge the productivity gap between them and digital industries, thereby enhancing the productivity of the entire economy. COVID-19 has highlighted the key role played by digitalization in bolstering industry resilience. As 5G+ matures and becomes pervasive, the ecosystem expands and physical industries increasingly adopt it, we will see an acceleration in value diffusion across the economy.

3. To what extent has COVID-19 highlighted the need for digitalization in industries?

The pandemic has served as an acute reminder that digitalization doesn’t merely enhance industrial growth and profitability, it also critically impacts society and the economy. For example, the sharp growth in video conferencing and telemedicine demand is a testament not only to the effectiveness and maturity of digital services in filling gaps in supply at short notice, but also to the sustainability and resilience of these services. Physical industries now must prepare to augment themselves to reap similar benefits.

As industries and enterprises embrace the “new normal” and prepare for a post-COVID world, they must capitalize on the emerging digitalization opportunities and challenges that are set to accelerate the “inversion” of global value paradigms.

4. What strategies should physical industries adopt to reduce the gap with their digital peers?

Enterprises within physical industries need to identify the areas that are likely to give them safety, productivity, efficiency (SPE) and resilience gains, define the appropriate metrics, determine the target improvements, and then drive the selection and confluence of Operations Technologies (OT) and ICT. Enterprises must ensure that all operational data are made available in digital form in a timely manner at the highest quality levels.

Enterprises need to deploy digitalization and automation in lockstep with the reskilling of their workforce. They should create a co-development environment with their operations technology supplier, communications providers and other ecosystem partners. As some of the OT and ICT have not fully matured yet, they need to develop a “no-regret” technology deployment roadmap that will help them shorten the time to optimum digitalization without any stranded investments.

5. How will 5G+ impact ICT spending in the future and bolster the global economy?

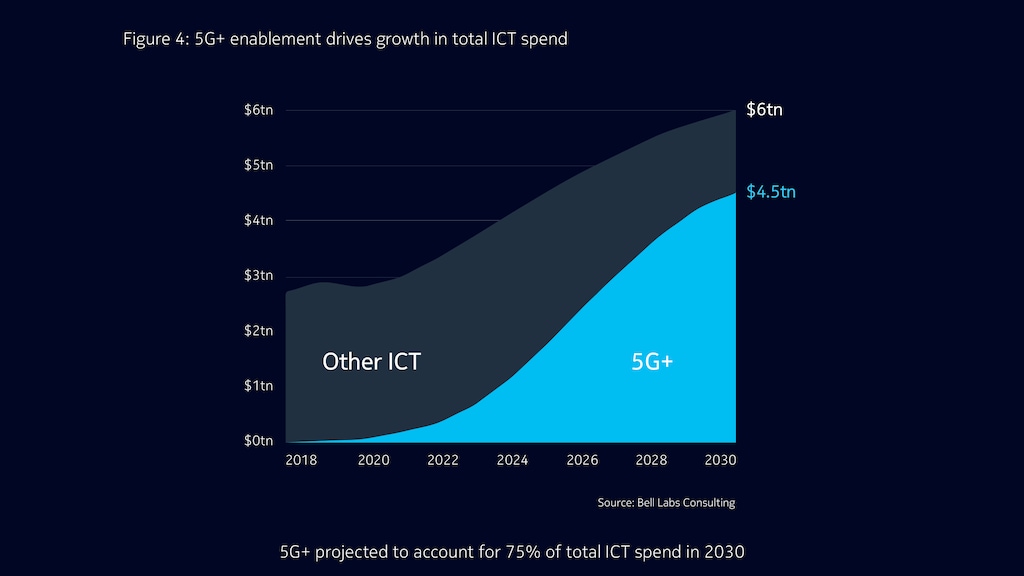

5G+ will increase physical industries’ ICT spend as enterprises begin to realize SPE and resilience gains. It will also channel ICT spending into areas associated with 5G+ (such as AI/ML, video analytics, sensing, robotics, etc.) that are the major contributor to these gains. We project that ICT spend will grow to $6 trillion in 2030 and 5G+ will account for 75% of this spend.

Economic growth occurs as increases in direct ICT spending and the resulting economic gains experienced by each industry cascades through the ecosystem to generate additional, indirect ICT spending and increased profitability in associated industries. This generates a multiplier effect that not only increases the cross-industry flow of goods and services and overall industrial output but boosts it further by creating additional consumption induced by household income growth. The overall growth in global economy reflects not only the economic gains of individual regions in of themselves, but also the increase in inter-regional trade.

6. Will digitalization compel a revaluation of businesses strategy and productivity paradigms?

Yes, it will. Especially in a post-COVID world seeking the new normal.

Digitalization will increase the scope of strategy and productivity paradigms to be more expansive and will shorten the planning horizon. Business strategies need to evolve in order to maximize the gains realized from demand-side and supply-side opportunities, while simultaneously meeting the challenges efficiently. New and faster strategy development will be required in many areas—such as a no-regret approach to roadmap 5G+ investments, workforce reskilling, incorporating green technology, data security and privacy, etc. Operating at higher SPE levels in an automated environment that shortens product/service realization time will require more dynamic strategy formulation and competitive evaluation paradigms.

COVID-19 has helped establish resilience as an integral part of productivity paradigms. But increased resilience can oftentimes increase costs and reduce enterprise efficiency. Digitalization reduces the negative impact of this trade-off by strongly increasing enterprise flexibility and adaptability. Tracking these metrics needs to be an integral part of any productivity paradigm going forward.

7. How much of a lag would there be between regions, especially when digitalization requires significant investments that parts of the developing world might not be able to afford?

Developing countries have historically lagged developed countries in technology adoption. Although this lag was in the range of 25-40 years for “physical” technologies, it has come down significantly to approximately 10-15 years for “digital technologies.”

While the gap between rich and poor nations will likely widen in the near term, we also see many opportunities for poor countries to leapfrog several technology generations by making strategic investments, especially as software is increasingly assuming the major role in digitalization. Digital transformation involves not only deployment of “technologies” but also large-scale upgrading of workforce skills. Strong government support in terms of financial subsidies and policymaking at that national level will be required to ensure that that this transformation occurs rapidly with minimal disruption.

8. How will digitalization help physical industries reach sustainability goals?

We will use the World Economic Forum (WEF) Sustainable Development Goals to characterize sustainability. It has laid out 17 goals. Digitalization is directly contributing to at least 4 of these goals.

• Affordable and clean energy: Energy efficiency is a major performance goal for digitalization. Significant improvements in energy consumption per output (for example, kilowatt-hour/Mbps of data carried on a network) have been achieved over the past decade. With increasing use of AugI/ML techniques and sensor technologies, 5G+ can drive optimization of energy consumption.

• Decent work and economic growth: Prior work from Bell Labs Consulting in “Rise of the new-collar worker” has shown that worker and workplace augmentation leads to higher employment and wages, and in many regions, has also led to fewer work hours. Digitally skilled workers are also more sustainable with greater employment stability as they can move from one industry to another more readily.

• Industry, innovation and infrastructure: Through its focus on SPE and resilience growth, 5G+-enabled digitalization improves enterprise and industry profitability. Remote operations of facilities are not only enabling productivity improvements but also improving workplace and infrastructure safety.

• Responsible consumption and production: A key component of SPE growth is the minimization of waste. Through its innovative use of AugI/ML and sensor technologies, 5G+ tries to minimize the use of resources. Digitalization also enables greater democratization of production and wider distribution of manufacturing sites leading to logistics simplification and shorter order fulfilment time. For example, a production facility may no longer need central manufacturing and distribution of finished goods over a wide region by switching to distributed on-demand local 3D printing-based production.

Learn more:

- Download The Big Inversion whitepaper

- 5G Readiness Report

Resources:

About Nokia

We create the critical networks and technologies to bring together the world’s intelligence, across businesses, cities, supply chains and societies. With our commitment to innovation and technology leadership, driven by the award-winning Nokia Bell Labs, we deliver networks at the limits of science across mobile, infrastructure, cloud, and enabling technologies.

Adhering to the highest standards of integrity and security, we help build the capabilities we need for a more productive, sustainable and inclusive world. For our latest updates, please visit us online http://www.nokia.com/ and follow us on Twitter @nokia.

Media Inquiries:

Nokia

Communications

Phone: +358 10 448 4900

Email: press.services@nokia.com