A wholesale business model for your optical network

In our last blog post, we discussed how to use the KPIs in your optical network to build automated closed-loop systems that simplify operational processes.

Now let’s explore another area of automation: how to monetize your optical infrastructure through a wholesale business model or by offering new business services directly to end subscribers.

Network operators have often leased fiber assets to end subscribers to generate revenues. While this business model is suitable for certain applications and it generates an immediate revenue stream, there are often limits to operators’ net potential revenue.

The end subscribers often consume only a fraction of the available total capacity on links in a network operator’s optical transport network. The network operator also plans for much larger connection capacity to get better economies of scale in their business. In doing so, the remaining bandwidth is often left underutilized until it can be sold to end subscribers over time. This translates to either short-term or long-term lost revenue potential for the network operator. In addition, network operators overbuild optical transport networks with additional capacity (e.g., with new links or new channels) to support growth in the networks or to drive new value-added service offerings for their end subscribers.

Network operators should consider other avenues to advertise and sell this excess connectivity bandwidth inventory — a different approach with a new business model.

About wholesale business models

Wholesale businesses have been adopted in almost every industry to sell the most widely used goods produced by a manufacturer directly to end customers in large volumes. In addition to purchasing goods at a lower price, wholesalers can earn revenue by selling them at a higher price through markups. The wholesaler doesn’t own any of the infrastructure or facilities to produce the goods, but it can inventory and sell the product to the markets and clients it specializes in.

A common example of wholesalers in telecommunications is mobile virtual network operators (MVNOs). These operators do not own any infrastructure. However, they purchase network services (the product) from mobile network operators in bulk and then set their own retail prices. This allows MVNO customers to generally get better pricing on the product (e.g., a data plan) while allowing MVNOs to maximize their profits because they benefit from the slightly lower price they pay for the network services.

New wholesale business model ecosystem

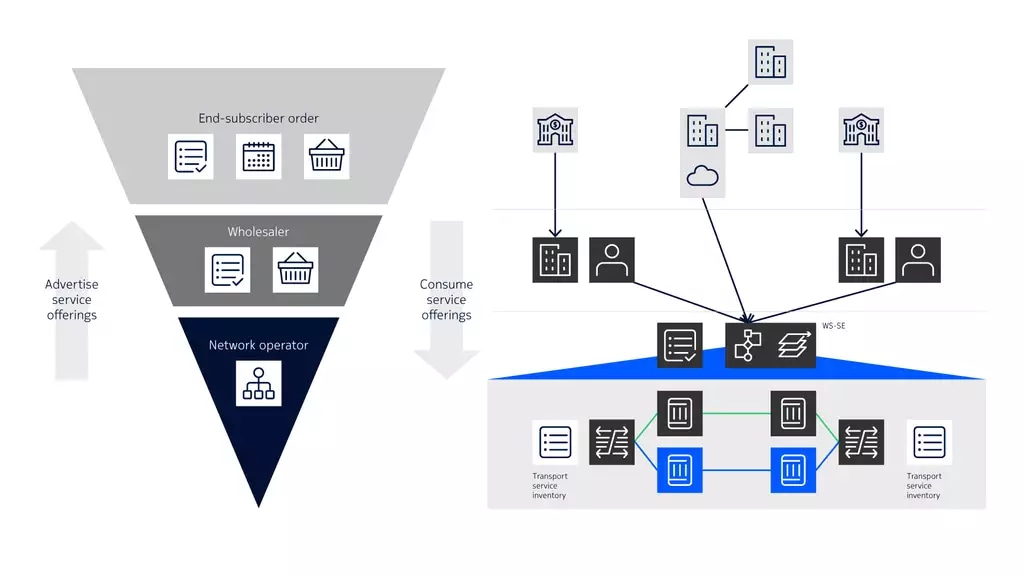

In the new wholesale business model ecosystem (see Figure 1), the network operator owns services that become the inventory to advertise either directly to the wholesaler or directly to the end subscriber. The wholesaler can inventory and purchase in bulk all these services and offer them to end subscribers within its addressable market. The various types of end subscribers (e.g., financial institutions, enterprise private networks, etc.) can order, schedule and consume services published by the wholesaler or by the network operator.

The Nokia WaveSuite Service Enablement (WS-SE) application creates the hierarchical tenancy needed to support the value chain for transport service inventory advertisement, service fulfillment and assurance reporting for each of the entities in this wholesale business model.

Figure 1. Ecosystem of new wholesale business model

Benefits of new wholesale business model

The new wholesale business model provides benefits for each member in the ecosystem.

End subscribers

- Purchase the services best suited for their business needs at a lower cost

- Improve user experience and business operations by automating their existing business support systems, including ordering and invoicing

Network operators

- Deliver more services, enabling them to invest in new capital resources and better plan their growth

- Reach new markets that they may have struggled to enter in the past

Wholesalers

- Can achieve better penetration in markets than traditional network operators because of their client relationships and the ability to scale their business into different regions

- Monetize service capacity offerings without owning any capital optical infrastructure and without operational costs for carrying these services

- Enrich the value of the service capacity offering by developing new bundled offerings, such as compute and storage facilities

- Can concentrate on their business core competencies: the user experience of service offerings, such as focusing resources on automation

The digital economy, cloud services and next-generation access such as 5G and PON (passive optical networking) are all driving increased demand for optical connectivity. This provides an opportunity for network operators to leverage wholesaler channels to expand and to capture new subscribers to grow their business. These new opportunities combined with new application use cases (such as ultra-reliable low-latency communications and massive machine-type communications) are driving network operators to build out new optical connectivity and capacity in their networks for use by wholesale partners.

With automation enabled by Nokia WS-SE, each of these new growing sectors can now begin to stay more synchronized, driving economic expansion for the whole ecosystem.

Why wholesalers need automation

While wholesalers can access different markets with a variety of end subscribers, each with its own requirements dictated by SLAs, the service inventory that the network operator must include is carried by the optical network. Even though wholesalers may not own the network infrastructure, they need to ensure that their revenue growth strategy includes enhancements for automating optical connectivity to support the traffic and services required by their subscribers.

To purchase these services in bulk and offer them to end subscribers requires wholesalers to directly connect the ordering system platform into the network operator infrastructure platform so that the network can immediately reserve and provision the connectivity for all customers of the wholesaler. Having network operators support a digital interface and business process to this inventory serves as a vital component for the wholesaler’s business success.

The rise of edge data centers, 5G and enterprise cloud services requires network connectivity inventory that includes:

- Failover capabilities

- Rapid provisioning

- Bandwidth on demand or spectrum optical services capabilities

- Security

- Low-latency interconnects

- Uplink rate diversity and scalability.

Automation that aims to expose the network service types, locations and availability, and then perform orchestration, is key to accelerating end-to-end service fulfillment and delivering these new capabilities. Network operators wanting to expand revenue can now leverage a new business model and offer their network as a service.

What’s next?

Our next blog will describe the components needed to build this bandwidth-on-demand foundation to monetize the service delivery assets within the optical network. Stay tuned.

Learn more

Blog series: Automating optical networks for success

Product: WaveSuite

Solutions: Insight-driven optical networks

Video: WaveSuite Service Enablement: Automate and accelerate the delivery of optical services

Application note: WaveSuite Service Enablement: A new service view for optical networks

Application note: Insight-driven optical networks: Automating networks with innovative business and network insights

Data sheet: WaveSuite Service Enablement