5G report: The value of 5G services and the opportunity for CSPs

3,000 consumers reveal what they really want from 5G.

6 minute read

The consumer market for 5G: What we learned, bg-blue-middle

1. They want 5G when they understand it

Demand for 5G enhanced mobile broadband (eMBB) increases significantly when consumers understand what it is and what it can do for them.

We found that 80% of consumers who understand 5G want it, compared with just 23% of those who aren’t familiar with it.

Next steps: Drive demand by showing consumers that 5G offers much more than “faster 4G”

2. They’re willing to pay more for 5G

Over half of survey respondents said they’d be willing to pay more for 5G. Focus group participants, however, said they’d look carefully at costs and at different providers' offers. This suggests that cost will be a consideration for adoption but not a barrier to it, and consumers show a willingness to pay more if they understand the 5G difference.

Next steps: Earn the right to charge a premium with attractive offers that go beyond faster connectivity

3. Engaged users will switch provider to get 5G

50% of respondents said they’re likely to switch provider to get 5G if their own provider doesn’t offer it in the next 12 months. Those most likely to switch – remote workers, video streamers, home monitors – are highly engaged users who will make substantial use of 5G capabilities.

Next steps: Roll out 5G early, find engaged users, and entice them to switch with high-value offers that align with their current 4G use

4. Opportunities abound for CSPs to expand beyond connectivity

Our survey revealed a strong appetite for 5G-enhanced services in many areas, from fixed wireless access to home monitoring and real-time drone video, to cloud gaming, AR-based translation, precise navigation, and more.

Next steps: Explore the potential for higher-value 5G services and forge partnerships to maximize market reach.

Top consumer 5G use cases

1. Fixed Wireless Access

Overview

Consumers see 5G FWA as a viable alternative to wired broadband

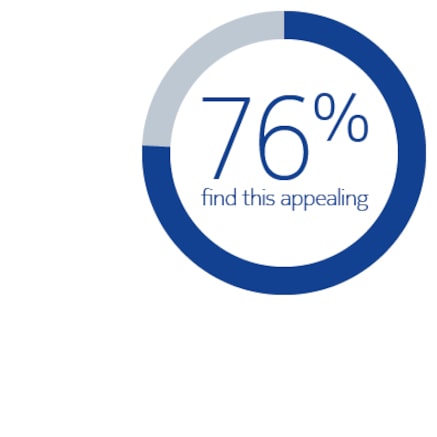

Respondents were overwhelmingly interested in FWA in the home, with 76% rating it as appealing – even higher than eMBB.

These findings validate the perception of FWA as a promising near-term opportunity for CSPs.

Better service

Consumers are generally happy with the speed of their wired home broadband, but many are frustrated with the service they get for their money.

Respondents said they’d be willing to pay the same or more for 5G FWA if the service is at parity or better than their current broadband connection – citing unlimited data, no throttling, and transparency about expected speeds as examples. Over 80% find easy DIY installation, with no need for an engineer visit, a valuable benefit.

More choice

A lack of choice among wired broadband providers means many consumers are willing to look at 5G FWA as an alternative.

In addition to their mobile provider, they’re open to considering 5G FWA offers from companies they already have relationships with, like tech giants, pay-TV providers, and utility companies. MVNO partnerships with those providers could open up new opportunities.

Next steps

Employ case studies and social proof to convince prospective subscribers that FWA can be as good or faster and more reliable than wired broadband.

Explore new pricing models: Innovative offers like DIY installation with a one-month free trial, or all-you-can eat data plans, could convince consumers to switch from their wired provider.

Forge partnerships to expand adoption: MVNO partnerships could help to maximize reach.

Learn more about the Fixed Wireless Access use case

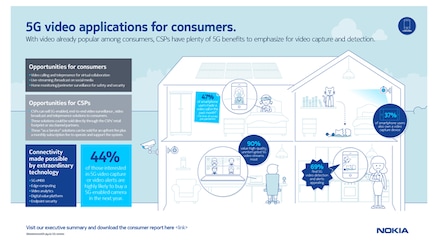

2. Video

Overview

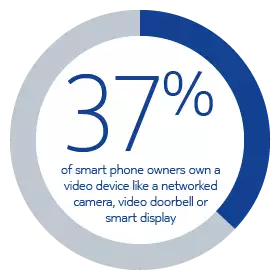

Video applications are already popular, and consumers are ready to hear how 5G can enhance them further.

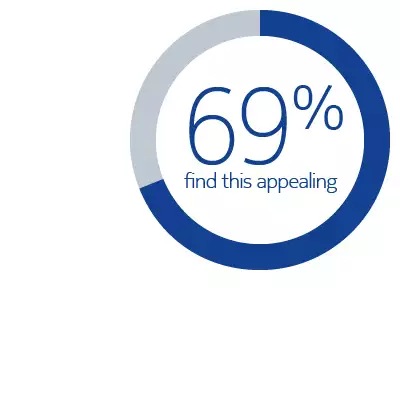

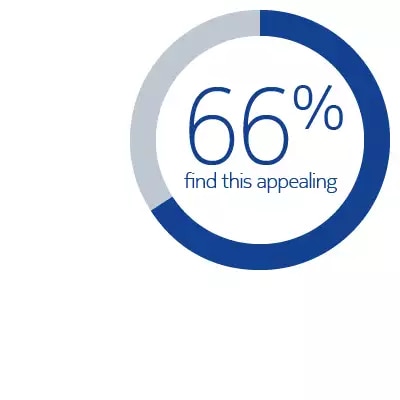

Consumers find video the most appealing 5G enabled service after FWA, with 66% finding video capture and streaming services appealing, and 69% saying video detection and alerts hold high appeal.

The key to success will be in targeting consumers with 5G video services that are most appealing to them.

Video applications are already popular, and consumers are ready to hear how 5G can enhance them further.

Consumers find video the most appealing 5G enabled service after FWA, with 66% finding video capture and streaming services appealing, and 69% saying video detection and alerts hold high appeal.

The key to success will be in targeting consumers with 5G video services that are most appealing to them.

Even before COVID-19 drove the world to work and learn from home, consumers wanted better-quality video calls.

68% rated high quality, uninterrupted video streams a “very valuable” aspect of 5G, with 65% giving the same rating to high-resolution video, and 64% to video capture on the go.

Demand for high-quality capture, streaming and calling will grow as consumers use more video, more often, in more ways. CSPs will need to show that 5G offers a markedly better experience than 4G.

Whether it’s security monitoring of a front door, perimeter or second home, or video monitoring and detection to keep a vulnerable loved one safe, people increasingly want technology that can reliably keep watch and alert them if something happens.

With new monitoring devices launching all the time, 5G will be a key enabler to ensure that video detection and alerting services deliver on their promise. Wire-free monitoring will be a key differentiator for 5G over 4G.

As more people use video calling to work remotely and stay in contact with family and friends, show how 5G makes those social interactions seamless.

Highlight the benefits of 5G for mobile video

Target consumers interested in high-quality, high-definition video capture and streaming on the go – especially from bikes and drones.

Talk about specific uses for detection and alerting

Promote remote detection and alerting services such as perimeter monitoring and caregiving applications.

Learn more about the video use case

3. Immersive experiences

Overview

AR has the broadest appeal, with pockets of highly engaged users finding 5G-enabled VR and cloud gaming appealing.

There are interesting contrasts between familiarity and adoption. While over two-thirds of respondents are familiar with VR, less than 20% currently own a VR headset. By contrast, less than half of consumers are familiar with AR as a term, but 63% have tried an AR application of some kind.

AR has the broadest appeal, with pockets of highly engaged users finding 5G-enabled VR and cloud gaming appealing.

There are interesting contrasts between familiarity and adoption. While over two-thirds of respondents are familiar with VR, less than 20% currently own a VR headset. By contrast, less than half of consumers are familiar with AR as a term, but 63% have tried an AR application of some kind.

AR was the most popular of the three immersive use cases we explored with consumers, appealing to 66% of respondents.

Over one-third of consumers found 5G AR experiences for remote commerce appealing, and social isolation during COVID-19 may increase the appeal of AR-enhanced shopping by allowing consumers to try out items from the safety of their home.

From focus group discussions, we learned that specific AR use cases resonate better with consumers than talking about ‘augmented reality’ as a whole.

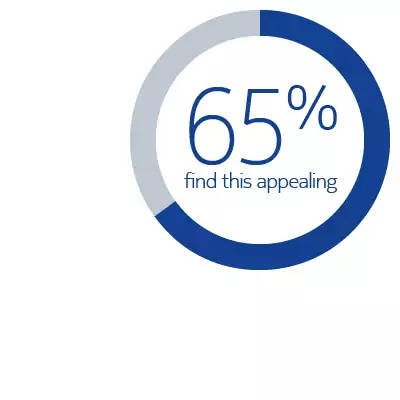

VR is a more widely-understood term than AR, and 65% of respondents said they find it appealing. Self-isolation and social distancing may prove a catalyst for VR adoption, allowing people to experience places and events without leaving home. CSPs may also find pockets of traction among niche segments like dedicated gamers.

Those audiences will be interested in 5G’s ability to send data to the cloud for processing, paving the way for lighter, less expensive headsets and the ability to play anywhere.

Cloud gaming emerges as a key driver of 5G demand, albeit among a niche audience of dedicated gamers.

Gamers love the potential of 5G and cloud to allow them to play high-quality games anywhere, without having to buy an expensive console. The ability to switch between devices, and the promise of a lag-free gaming experience are also key points of interest.

Augmented reality: Highlight the value of 5G for individual applications, rather than AR as a whole. Example demographics include people who travel and who shop online using their phone.

Virtual reality: Show how 5G can make VR more accessible, more seamless and less expensive, with lightweight, wire-free headsets that enable enriched experiences everywhere.

Cloud gaming: Attract gamers with offers like free cloud gaming trials or bundles, exclusive 5G-only content from game developers, or own-brand game streaming services.

Learn more about the immersive experiences use case

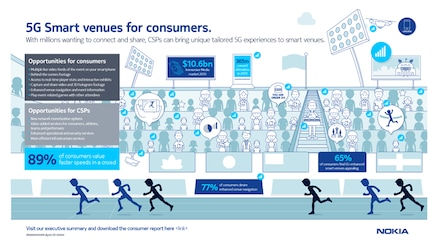

4. Smart venues

Overview

Better connectivity and service reliability in congested areas are easily understood and highly appealing aspects of 5G.

Nearly two-thirds (65%) of respondents find the idea of 5G-enhanced venues appealing – whether it’s a stadium game, concert, festival, theme park, museum, or any other place where lots of people congregate.

Better connectivity and service reliability in congested areas are easily understood and highly appealing aspects of 5G.

Nearly two-thirds (65%) of respondents find the idea of 5G-enhanced venues appealing – whether it’s a stadium game, concert, festival, theme park, museum, or any other place where lots of people congregate.

As the world starts to recover from COVID-19, people will once again seek the company of others at concerts, sports games, shopping centers and theme parks.

When that happens, connectivity will be key to their experience. 65% of respondents found the idea of 5G-enabled smart venues appealing, with 89% of those saying they wanted to be able to stream video and upload images – which isn’t always possible with 4G.

Respondents cited 5G-enabled services like live video streams from other games or areas of the venue, AR displays to aid navigation, and the ability to share video and 3D hologram footage as attractive benefits of 5G.

Offer new services: 30% of consumers said they’d be willing to have smart venue experiences – like AR-enhanced navigation and 3D hologram creation – added to their mobile bill.

Explore new revenue models: Opportunities include tie-ups with venues and sports teams, as well as geolocation targeting with offers when consumers enter a 5G-enabled venue.

Develop new partnerships: Focus on connectivity in smart stadiums, and explore working with master property developers to future-proof infrastructure for commercial and corporate clients.

Learn more about the smart venues use case

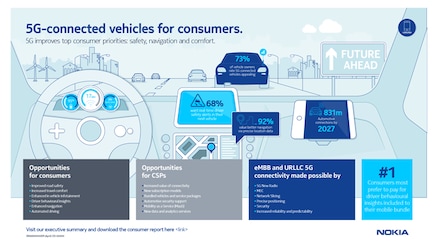

5. Connected vehicles

Overview

The majority of vehicle owners are interested in enhanced connectivity in the car, especially for road safety and enhanced navigation.

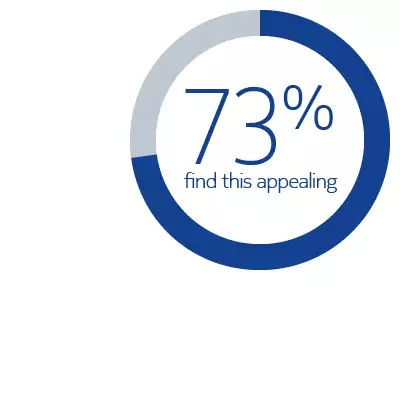

73% of vehicle owners found the idea of vehicle connectivity appealing, making connected vehicles an interesting use case for CSPs, particularly in markets with higher vehicle ownership.

The majority of vehicle owners are interested in enhanced connectivity in the car, especially for road safety and enhanced navigation.

73% of vehicle owners found the idea of vehicle connectivity appealing, making connected vehicles an interesting use case for CSPs, particularly in markets with higher vehicle ownership.

As cars get smarter, consumers’ expectations are growing of what their next vehicle will be able to do for them.

Navigation and safety are top of their priority list. 68% of respondents already use assisted driving features in their current car, and of those, almost all said they like the idea of new, 5G-enabled services like AR overlays for improved navigation, enhanced safety alerts, and notification of changing road conditions ahead.

Consumers said safety alerts, emergency services calling and precise navigation are all desirable features in their next vehicle.

Showcase services that aren’t possible with 4G

Precise navigation, high-quality streaming video for passengers, and real-time alerts of hazards ahead are all made possible with 5G.

Establish an ecosystem of partners

Carmakers, other OEMs, and dealerships are seeking new revenue streams. 5G is an opportunity for them to partner with CSPs for in-vehicle services and over-the-air updates.

Learn more about the connected vehicles use case

The consumer market for 5G: Conclusions and recommendations

5G is likely to be available to one-third of the world’s population by 2025. Consumers already know it will bring them faster speeds and better connectivity. But beyond the basics, our research shows that demand for an array of 5G-enabled services is just waiting to be unlocked.

Key conclusions and recommendations from the consumer 5G research report are:

- Consumers want 5G when they understand it: Drive demand by showing consumers that 5G offers much more than ‘faster 4G’.

- Consumers are willing to pay more for 5G: Earn the right to charge a premium with attractive 5G offers that go beyond faster connectivity.

- Engaged users will switch provider to get 5G: Roll out 5G early, find engaged users, and entice them to switch with high-value offers that align with their current 4G use.

- FWA and video are the top use cases beyond eMBB: Unlock demand for 5G FWA with attractive pricing offers and success stories. For video, emphasize speed, quality and wire-free capabilities.

- Opportunities abound for CSPs to expand beyond connectivity: Explore the potential for higher-value 5G services and forge partnerships to maximize market reach.

Get the full 5G research report

Get the complete inside track on what 3,000+ consumers told us about their expectations for 5G in our in-depth research report: The value of 5G services: Consumer perceptions and the opportunity for CSPs.

You’ll find:

- Detailed quantitative analysis of consumer demand for five 5G use cases

- Qualitative insights from four US consumer focus groups

- Key takeaways and actionable insights you can use in your 5G planning

Explore our infographics

Who we spoke to for this 5G market report

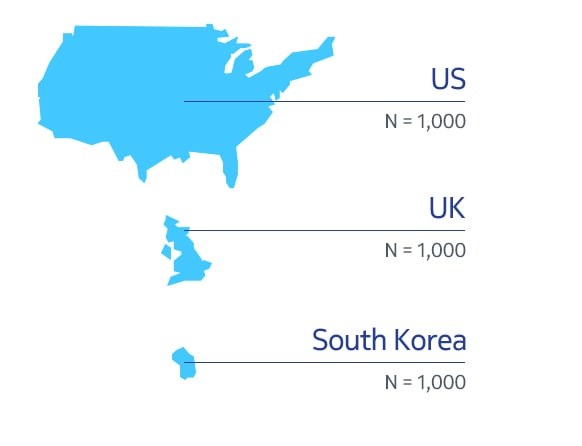

The data in this report is drawn from a survey of 3,000 consumers conducted by Parks Associates for Nokia and completed in January 2020. The margin of error for results based on the full sample size is +/- 3%

Geographical markets

We surveyed 1,000 smartphone users in each of three markets: United Stated, United Kingdom and South Korea.

Demographics

We surveyed adults aged 18 and older who are smartphone owners, broadband internet users, and the primary decision makers in their household. Demographic quotas set for age, gender, and household income ensured samples were representative of the population of each market surveyed.

Further qualitative data and insights were drawn from four focus groups with 30 participants, held in November 2019 in New York and Dallas.

Ready to talk to us?

Please complete the form below.

The form is loading, please wait...

Thank you. We have received your inquiry. Please continue browsing.