On the road to Web3

Technology Vision

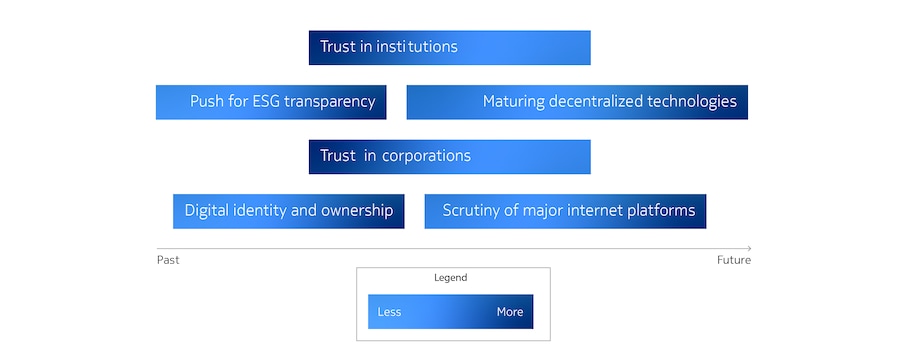

Our world is undergoing significant transformations, driven by several key macro trends. Individuals and organizations are increasingly embracing digital-first approaches for identity, citizenship, incorporation, and asset ownership. Simultaneously, trust in centralized institutions and platforms is waning, as evidenced by recent political events, pandemic responses, and privacy concerns. Major internet platforms face growing scrutiny from regulators and critics, resulting in substantial fines and public backlash.

Simultaneously we observe growing recognition and adoption of digital assets like cryptocurrencies and new digital identity standards across consumer, business, and financial sectors, with recent positive developments in the U.S. crypto landscape. Environmental, Social, and Governance (ESG) demands are pushing for greater transparency in decision-making and governance processes. Additionally, the underlying blockchain technology is maturing rapidly, offering improvements in cost-effectiveness, performance, and security. These elements collectively contribute to the evolving digital ecosystem, paving the way for new Web3 paradigms in how we interact with and trust digital platforms and assets which.

What is Web3 and how is this different from Web2.0

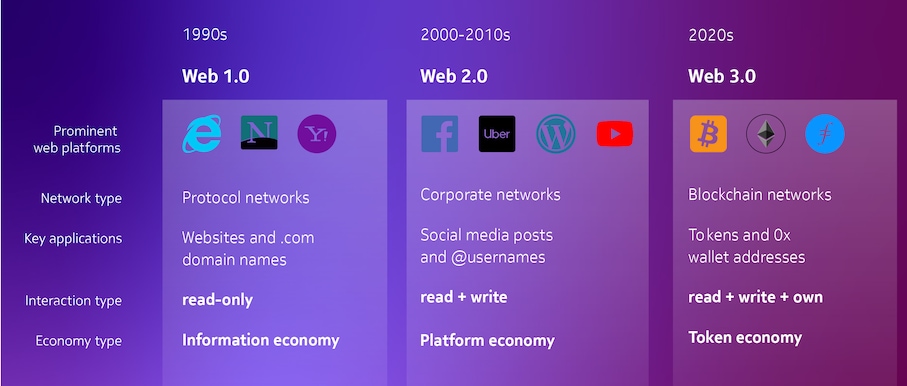

Web3, often referred to as the "third wave" of World Wide Web innovation, represents a significant evolution in how we interact with and utilize the Internet. To understand its significance, it's essential to review its predecessors. Web 1.0, emerging in 1989, introduced open standards and protocols that allowed anyone to create websites, but was primarily "read-only." Web 2.0, beginning in the early 2000s, saw the rise of large platforms like Google and Facebook, making the web "read + write" and significantly impacting society, but at the cost of creating "walled gardens" and proprietary APIs.

The Bitcoin Project, launched in 2008, introduced the concept of blockchain and digital scarcity. It enables peer-to-peer transactions without intermediaries, verifiable ownership of digital assets, and community-driven accountability. Web3 services often incorporate tokens as key features, fostering a "token economy" that rewards contributors and attracts users.

Web2 corporate networks, exemplified by platforms like Facebook, are centralized services owned and operated by a single entity. Users authenticate with usernames and passwords stored in proprietary databases, along with all user data. The service logic, including algorithms determining content delivery, is proprietary and can be changed unilaterally by the company. In contrast, Web3 blockchain networks, such as Helium, operate on a decentralized model. Users authenticate using cryptographic keys stored in personal wallets, and data is recorded on a communal blockchain ledger. The service logic is open- source, allowing for transparency and community verification. Updates to the system require consensus from a network of independent operators, creating a more democratic governance structure that balances the interests of the service provider with those of the user community.

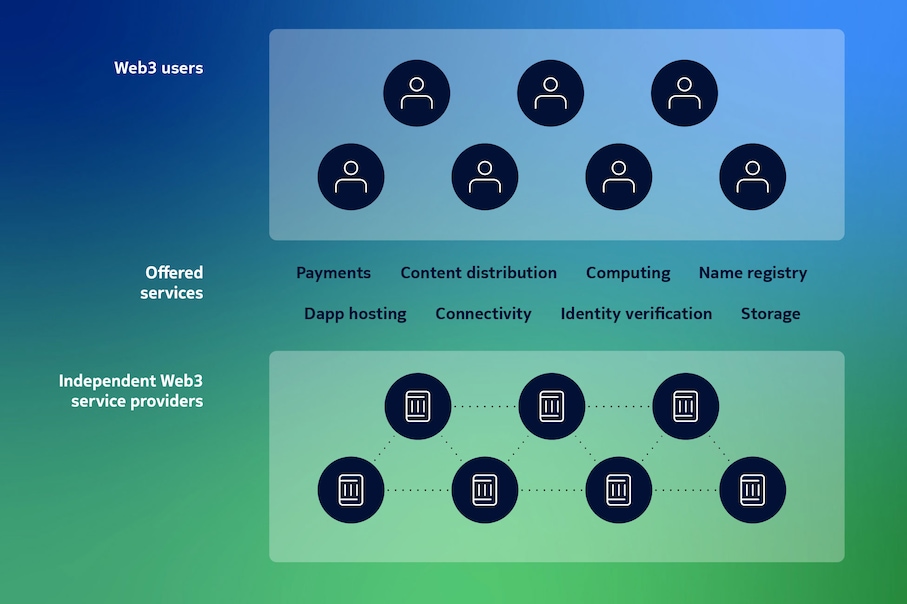

Web3 users

- Get service at market-competitive prices

- No gatekeepers that may censor transactions

- Retain full ownership/custody

- High service assurance

Independent Web3 service providers

- Low barrier to entry (no license-to-operate needed)

- Earn rewards proportional to work/resources contributed

- Level playing field(clear and immutable rules of play)

How does Web3 work?

Web3 revolutionizes digital trust by rooting it in mathematics rather than human organizations, leveraging public-key cryptography as its foundation. Built on peer-to-peer networks, Web3 utilizes blockchain and self-certifying protocols to create decentralized systems where transactions are verified cryptographically without central authorities. These blockchain networks maintain decentralized ledgers that securely record tokens representing various assets, including currencies, ownership rights, and NFTs. While NFTs gained fame through digital art, they're versatile digital containers for representing diverse ownership rights . Tokens often serve as incentives in online interactions, while smart contracts—automated agreements stored on blockchains—function as "programs with bank accounts," autonomously managing digital assets and facilitating trust between parties.

The application layer forms the pinnacle of the Web3 stack, showcasing innovative technologies in action. This layer encompasses several groundbreaking areas: Decentralized Finance (DeFi), Decentralized Social Media (DeSo), Decentralized Physical Infrastructure Networks (DePIN), Decentralized Autonomous Organizations (DAOs), Decentralized Identity (DID), tokenization of Real-World Assets (RWA). These cutting-edge domains represent the practical applications of Web3 technology, reshaping how we interact with digital systems. As we explore each of these exciting areas further down the page, you'll discover how they're transforming the digital landscape and opening up new possibilities for decentralized, secure, and user-centric interactions.

Five main areas of Web3

Decentralized Finance (DeFi)

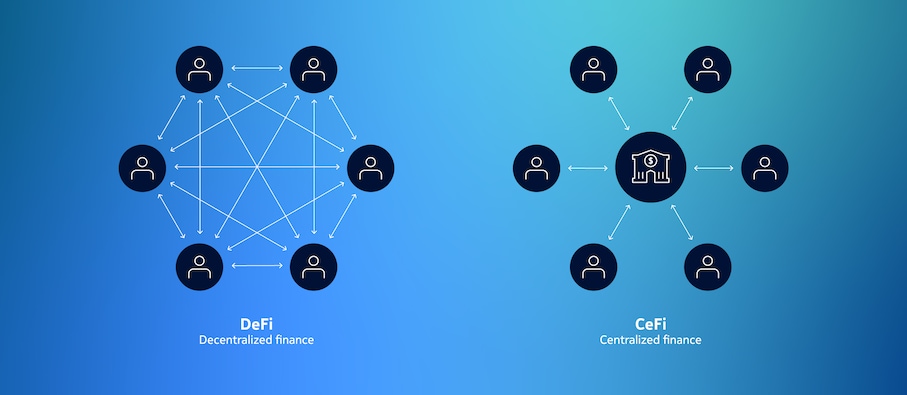

Web3 is revolutionizing the financial industry, much like how Web 1.0 disrupted media publishing. Decentralized Finance (DeFi), the largest and oldest sector in Web3, offers an alternative architecture for trusted value exchange with reduced dependence on central intermediaries. DeFi aims to recreate existing financial services without traditional intermediaries like banks or brokerage firms. At its core are "smart contracts" - algorithms stored on blockchains that automate services such as exchanges, lending, and settlement.

The impact of DeFi is already significant, with stablecoins like Tether and USDC emerging as de-facto "digital dollars" used worldwide. In 2024, the Total Value Locked (TVL) in DeFi smart contracts ranged between $80-100 billion, excluding major cryptocurrencies like Bitcoin and Ethereum. This growth suggests a future where companies might start accepting payments from customers and suppliers using digital currencies rather than standard fiat currencies. As DeFi continues to evolve, it presents both challenges and opportunities for traditional financial systems and corporate finance strategies.

DeFi technology has also found a significant application in prediction markets, where users buy and sell shares in the outcomes of real-world events. In Web3 prediction markets, smart contracts automatically escrow bets and settle payouts, while a decentralized network of oracles determines event outcomes, enhancing security and transparency. The potential of these markets was dramatically demonstrated during the 2024 US Presidential Elections, where the Web3 platform Polymarket attracted a record $3.6 billion in bets, far surpassing traditional prediction markets. This high-profile event, coupled with the market's accurate early prediction of the outcome, sparked renewed interest in the role and accuracy of blockchain-based forecasting.

Decentralized Social Media (DeSo)

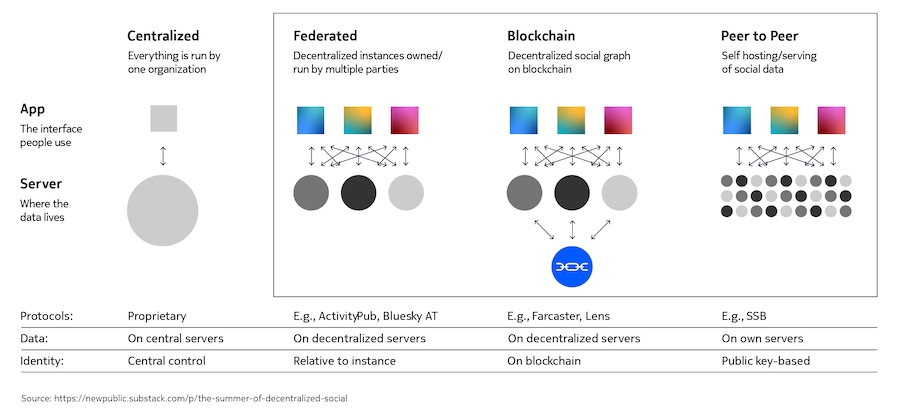

Decentralized social networks (DeSo) represent a paradigm shift in the digital landscape, offering platforms where infrastructure, operations, moderation, and royalty payments are no longer controlled by a single entity. This innovative approach gained significant momentum in 2023-2024, partly accelerated by the turmoil following Elon Musk's acquisition of Twitter in late 2022. While these alternatives remain small compared to established platforms, they are addressing crucial questions about ownership of the social graph, content creator autonomy, and the potential for a new "Creator Economy."

DeSo networks like Farcaster, Bluesky, Mastodon, and Nostr are paving the way for a future where content creators can have more control over their audiences and income streams. Mastodon's federation model, for instance, boasts over 17,000 interconnected communities hosting about 2 million active user accounts as of July 2024. As the concept of decentralized networks gains traction, it raises intriguing possibilities for the future: Could we see decentralized versions of essential services like Google search, ChatGPT, or even established media outlets? The potential for community-owned networks to reshape digital services considered "public goods" is a trend worth watching in the coming years.

Decentralized Physical Infrastructure Networks (DePIN)

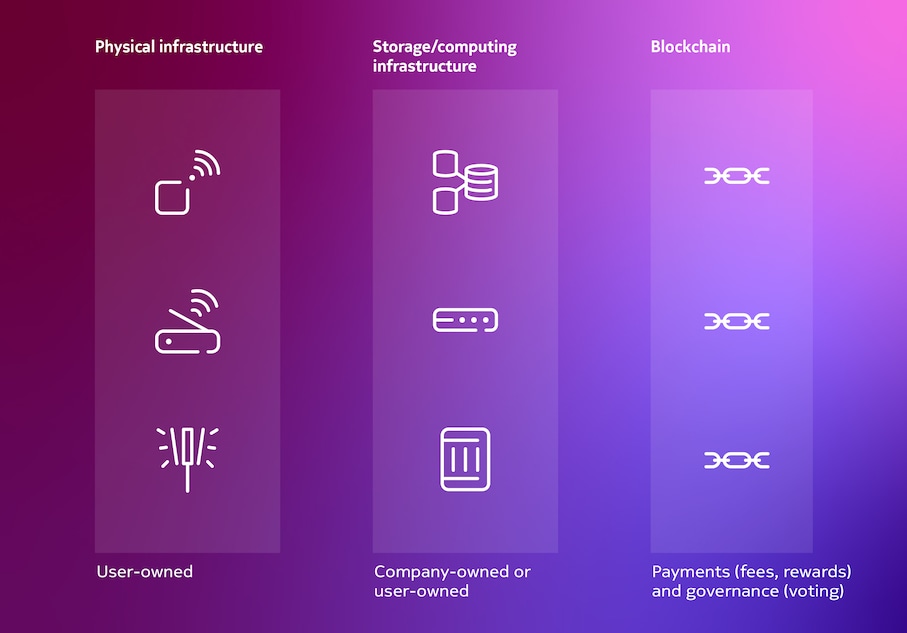

Decentralized Physical Infrastructure Networks (DePINs) are emerging as a significant area of interest for consumers and providers. These public utility networks provide services such as file storage, computing power, content distribution, and network connectivity, utilizing "utility tokens" for service consumption. DePINs leverage token incentives to coordinate the efficient buildout and operation of infrastructure across six major categories: AI, Compute, Energy, Wireless, Services, and Sensors.

The supply-side development of these networks has already begun and is expected to grow substantially in the coming years, driven by increasing demand for compute resources in areas like AI, zero-knowledge proofs, and video/metaverse applications.

DePIN projects promise several advantages, including crowd-sourced capital expenditure, lean on-chain operational expenses, enhanced resilience through decentralization and verifiability, and support for open ecosystems that foster higher rates of innovation. While "Storage" and "Compute" DePINs (essentially decentralized cloud services) are currently the most established, other areas like decentralized wireless (DeWi) are gaining traction, enabled by technologies such as CBRS, eSIM, and neutral host interoperability. As these networks grow, they are likely to evolve into platforms catering to diverse use cases, exemplified by projects like Helium expanding from IoT to cellular and WiFi services. The adoption of DePINs may follow a "gradually, then suddenly" pattern, driven by compounding network effects.

Decentralized Autonomous Organizations (DAOs) & Decentralized Identity (DID)

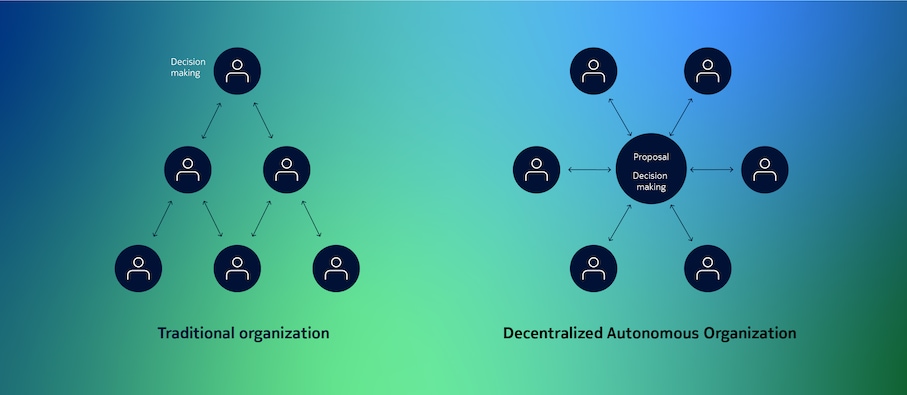

Decentralized Autonomous Organizations (DAOs) are emerging as innovative governance systems for digital cooperation and decision-making, leveraging smart contracts for automated execution of decisions, proposals, and rules. These entities are already being adopted for company-internal processes, with their impact on broader ecosystems expected to accelerate over the next 5-10 years. DAOs are particularly notable for their ability to manage shared treasuries through collective action, as exemplified by platforms like Uniswap exchange and MakerDAO stablecoin, which manage billions in assets, and Gitcoin's crowd-funding platform, which has facilitated millions in donations across thousands of software projects.

DAOs represent a digital-first approach to organizational structure, combining elements of traditional companies with unique features enabled by blockchain technology. They often incorporate novel decision-making systems such as quadratic voting and quadratic funding, pioneered by initiatives like the RadicalxChange Foundation. The growing ecosystem around DAOs is supported by a variety of tools and platforms that simplify the process of joining, launching, and managing these organizations, making them increasingly accessible to a wider range of participants. As DAOs continue to evolve, they have the potential to reshape how we think about governance, collaboration, and resource allocation in the digital age.

Self-Sovereign Identity (SSI) technology on the other hand is trying to revolutionize how we manage our digital identities, potentially eliminating the need for traditional usernames and passwords. This innovative approach allows users to "own" and manage their identities through digital wallet apps, while websites can attach fraud-proof, verifiable credentials to these identities. The concept is gaining traction rapidly, with Gartner predicting that by 2026, at least 500 million smartphone users will regularly use digital identity wallets built on distributed ledger technology for making verifiable claims.

SSI technology also enables greater interoperability across systems, with industry standards like W3C DID, Verifiable Credentials, and DIF DIDComm emerging to support its implementation. SSI has broader implications, including proof-of-personhood systems to verify human users in an increasingly AI-dominated online world, and the tokenization of identity or credentials through concepts like Soulbound tokens (SBTs) and Proof-of-attendance-protocol (POAP) in blockchain networks. Mobile operators are well-positioned to play a crucial role in supporting and operating decentralized identity frameworks, potentially reshaping how we interact with digital services and manage our online presence.

Tokenization of real-world assets (RWA)

Real World Asset (RWA) tokenization is an emerging trend that involves creating digital tokens on blockchain networks to represent tangible assets such as real estate, vehicles, and other physical items. This technology provides a secure digital foundation for trading, managing, and securing these assets. The RWA market experienced significant growth in 2023, with the aggregate token values of RWA projects surging from less than $1 billion to $6 billion. While this growth is impressive, it still represents a tiny fraction of the potential market, considering that global real estate alone was valued at $326 trillion in 2020.

The impact of RWA tokenization is far-reaching, enabling fractional ownership of high-value properties and making previously inaccessible investments more attainable for a broader range of investors. It also enhances liquidity, facilitating easier trading of traditionally illiquid assets. Beyond real estate, RWA tokenization is being applied to various sectors, including commodities, carbon credits, art, collectibles, and even credentials like titles and diplomas. A notable example is the State of California's DMV issuing 42 million digital car titles on the Avalanche blockchain in July 2024. The technology also extends to proof-of-personhood concepts, such as Worldcoin's tokenization of human iris scans to verify human users in an increasingly AI-dominated online world. As the market continues to grow, led by tokenized U.S. Treasuries and with major players like BlackRock entering the space, RWA tokenization is poised to reshape how we perceive, trade, and manage physical assets in the digital age.

Where do we need to look beyond communication

The regulatory landscape of Web3 is rapidly evolving as governments and regulatory bodies grapple with the challenges presented by this new technological paradigm. Key areas of focus include:

Cryptocurrency regulation

- Emphasis on Anti-Money Laundering (AML) and Know Your Customer (KYC) procedures.

- Overstight of crypto exchanges.

Securities law and token classification

- Determining whether certain tokens classified as securities.

Non-Fungible Tokens (NFTs)

- Adressing intellectual property rights and fraud prevention.

Expanding Web3 Regulations

- Taxation of crypto transactions.

- Implementation of digital IDs and wallets.

- Legal recognition of Decentralized Autonomous Organizations (DAOs).

Beyond finance, Web3 is also impacting telecommunications as decentralized networks challenge traditional regulatory frameworks

- Protocols like Helium and Althea are pushing decentralization, requiring telecom

companies to adapt their business models. - Existing regulations, such as net neutrality rules, may need reassessment to fit Web3's

decentralized nature. - Policymakers are striving to balance innovation with integrity and fairness, underscoring

the need for adaptive, forward-thinking regulatory frameworks.

Future world of Web3

The future of the internet is likely to be a blend of Web2 and Web3 technologies, often referred to as "Web2+3" or "Web5". While Web3 is expected to grow significantly, it's unlikely to completely replace Web2; instead, they will coexist and complement each other. A key question in this evolution is whether decentralized finance (DeFi) will remain the dominant application of Web3, or if other sectors will emerge as disruptive forces. The potential for rapid growth and mainstream adoption lies in areas like Decentralized Physical Infrastructure Networks (DePIN) or Decentralized Social (DeSo) platforms. If one of these networks achieves critical mass in the near future, it could dramatically increase the visibility and tangibility of Web3 technologies for everyday users, potentially accelerating the broader adoption of decentralized systems across various sectors. For enterprises, Web3 offers opportunities in identity and access management, tokenization of internal budgets, and operational efficiencies through automated business processes. Furthermore, Web3's automation capabilities may enable IoT devices to engage in autonomous financial transactions, revolutionizing machine-to-machine interactions in the telecommunications ecosystem.

Web3 technologies will make significantly impact to network architectures and telecommunications services. Public peer-to-peer networks will require increased uplink capacity and efficient internet peering, with true decentralization pushing resources to the network edge, including customer premises. Network latency will become crucial, driving innovations in data transmission, whereas Web3's secure identity stack may enhance device management on networks. Decentralized Wireless (DeWi) could be a "killer app" for shared open spectrum solutions, potentially partnering with incumbent CSPs to address coverage gaps.