Reality check: will XR break your 5G capacity scaling strategy?

As 5G ecosystem rallies behind XR, CSPs must rethink how to match capacity with growing demand.

In a remote factory in northern Finland, Nokia design engineers are simulating 360-degree physical environments and slipping on virtual reality (VR) headsets to collaborate on placement of massive MIMO antennas.

Similar scenes are playing out around the world as brands like Apple, Facebook, Google, Microsoft and others are busy concocting headgear, eyewear, bodywear and more in their augmented and virtual reality labs.

Are these opening salvos for the 5G capacity scaling requirements that communications service providers (CSPs) may soon face?

Consider the requirements for a typical VR test scenario: 2K optical resolution per eye per headset, at a 90Hz refresh rate, with an average latency requirement of 20 milliseconds, and data throughput at 50 Mbps. That’s up to five times more than the average 4G busy-hour capacity.

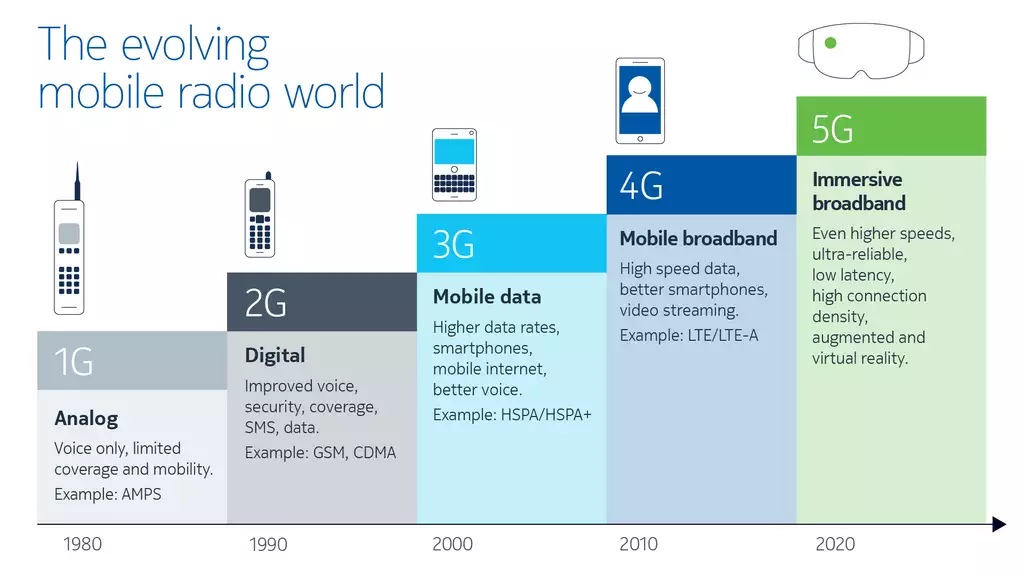

History shows there is an initial traffic uptick with each new generation of mobile. The apps that subscribers already use work better on the new network, driving a first wave of data. But history also shows a second traffic uptick, driven by new applications and devices that reset user behaviors. This second wave comes only after the new network radio and ecosystem advancements are fully understood.

Will history repeat with 5G? All that CSPs can really be certain about is that there isn’t enough power or space to keep building out capacity with traditional horizontal scaling methods. It’s a similar issue faced by IT organizations and webscalers – there’s no room for another box. Especially in the constraints of a radio cell site.

5G traffic: first wave indicators

5G has been available for some time, so what are the results from early mover nations when it comes to data consumed?

5G smartphone users on average consumed between 1.7 to 2.7 times more mobile data than 4G users in six leading 5G countries, says Opensignal, a mobile network experience measurement and analysis firm.

“Usage was greatest in South Korea where our smartphone users reached 38.1 GB of mobile data used. In all six markets, 5G users on average consumed more than 15 GB of mobile data,” Opensignal reports.

And in South Korea, even where 5G tariffing was higher, usage was up. So, despite the higher cost, subscribers will pay to play.

Still, in other regions, operators are using incentives to drive subscribers to the 5G network, and that has implications.

“Unlimited plans offer an incentive to switch in some markets and accelerate next generation adoption,” says Stephen Rose, a senior partner with Bell Labs Consulting for the Americas & Europe.

“However, as CSPs use these plans to migrate their subscribers to 5G or capture new subscribers,” he adds, “naturally we observe significantly greater data use. This means planning for more capacity and portfolio expansion are required to convert the traffic into added value.”

5G traffic: a second wave looms

There has been much in the news in the last few years about big brands making sizeable investments in consumer and enterprise XR—a catch-all term for augmented, virtual, and mixed or merged realities—and bringing products to market.

Products like HoloLens from Microsoft – built for the rigors of industrial environments – offer all the ingredients for VR to thrive when combined with the high capacity and low latency of localized enterprise computing and private wireless networks.

“The next mobile computing platform will be XR,” says Sajith Balraj, director of product management for XR and Gaming at Qualcomm Technologies, Inc., whose chipsets power more than 40 AR and VR headsets.

“Spatial computing is only possible when the benefits of 5G connectivity, edge cloud servers, and on-device processing in XR glasses all work together,” Balraj says.

The respective industry segments are not fully there yet. Access to high bandwidth, low latency 5G coverage is inconsistent today, for example. It’s also early days for ubiquitous edge computing away from specialized, on-premises projects. And broad XR adoption will need smaller, lightweight glasses with better power efficiency. (Glasses should last as long as a smartphone does today.)

“But we are well on our way down this development path,” Balraj says.

Jason Leigh, 5G and mobile research manager at analyst firm IDC, agrees a shift is coming for the mobile user. “How we interface with the digital world is about to change,” he says. From head down, fingers on screens to heads up, viewing a digital and real world together.

Big and small brands are all aggressively stoking the ecosystems, inventing new devices, games, and applications. At the same time, they’re quietly proving out enterprise use cases and conditioning consumers for the new technology.

In fact, says Catherine D. Henry, SVP 5G, XR and Innovation at MediaMonks, consumers are getting comfortable with AR without being completely aware they are using the technology.

“In 2020, 120 million users tried AR to trial new products. Whether it’s photo filtering in Snapchat or a background filter to spice up a friendly Zoom call or digitally placing furniture in your house when shopping online,” Henry says. “The number of people using AR is expected to climb to nearly two billion in 2022.”

Testing 5G capacity scaling assumptions

What we’re seeing now is a whisper, a low rumble of what’s possible in the 5G era. The traffic uptick for 5G in those early mover markets is natural and expected, but there’s more to come.

When and how the new apps emerge in the market—and alter user behaviors and expectations—remains an open question. But the barriers to adoption of a new interface between humans and computing are falling.

The 50 Mbps connection those assembly operators in Nokia’s factory need for VR collaboration is about 10x today’s recommended download speeds for cloud-streamed gaming. And although today this is supported by a private 5G network, it’s a safe bet only a fraction of companies can afford or will want to manage their own private cellular network. What proportion of a CSP’s user base will be expecting this level of service?

It’s impossible to predict the future capacity needs of 5G, or the implications for the network, when an application or class of applications goes viral. And with the brands already behind XR, there is high viral potential. If a CSP is building assumptions around today’s 2x uptick in traffic they could come up short. It is worth considering now how to cope with a 10x uptick – in a way that doesn’t include massive over provisioning ahead of demand.

Add to this the sustainability targets to which many CSP Boards of Directors are committing, as well as the very real power and space restrictions at cell sites.

If this is the first wave, network planners will have to rethink today’s horizontal approach to network scaling to handle a new generation of innovation. The second wave of traffic will demand far more network capacity while requiring far less energy, power and space.

CSPs must now begin to build for this faster future.

Intrigued by what you’ve read?

Product introduction video