5G report: Mapping the enterprise 5G opportunity

1,000 IT decision-makers reveal their perceptions of 5G services.

6 minute read

5G research report: Businesses reveal their 5G plans and expectations

5G technology was designed to enable business transformation in addition to providing faster connectivity for consumers. Much is said about the potential use cases for 5G in the enterprise sector, but does it match with real-world perception and demand?

To find out when and how organizations are planning to deploy 5G in their operations, Nokia conducted in-depth research with 1,000 IT decision-makers across seven vertical sectors and two key geographies: the US and the UK.

Complementing a parallel report on consumer demand for 5G-enabled services, this major new market research report reveals what businesses expect to achieve with 5G, where they see its value, and which providers they’ll look to for it.

Below you’ll find highlights from the report – with insights and advice for CSPs keen to start offering enterprise-grade 5G services.

5G enterprise use cases: What 1,000 IT decision-makers told us

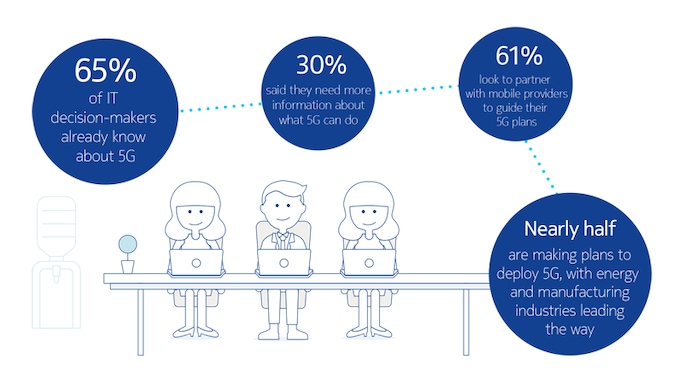

1. Most are aware of 5G and almost half are planning now

Nearly two-thirds of IT decision-makers are aware of 5G and 47% say their organizations have already started planning for it.

However, 30% told us they’d like to understand the value of 5G better before developing a plan to use it in their organization. This lack of information is the second biggest barrier to adoption after lack of 5G coverage.

Next steps: Increase education about the industry benefits of 5G to spur near-term adoption and provide enterprises with clear deployment roadmap.

2. Video is the #1 use case – and the most immediate opportunity

Video emerged as the “killer app” for 5G across industries and business sizes, with 83% finding it appealing and 48% citing 5G-enhanced video monitoring as a near-term opportunity.

75% of businesses surveyed already use video for monitoring purposes, but the high-value opportunities lie mainly with businesses that want to do more – by using video with analytics as a sensor to detect risks, defects and to enable real-time detection of faces, objects, risks, and incidents.

Next steps: Emphasize the capabilities of 5G for high-quality video streaming, monitoring and detection in remote and wire-free locations.

3. Energy and Manufacturing are leading the way

Energy and manufacturing firms show the highest awareness of 5G, and are exploring its potential for advanced use cases including infrastructure maintenance, remote machine control, and cloud robotics.

A move to remote operations following the Covid-19 pandemic may drive further 5G uptake.

Next steps: Inspire Energy and Manufacturing decision-makers with examples and use cases that meet sector-specific needs.

4. CSPs are well placed to succeed – but will find strong competition

61% of businesses said they would look to a mobile operator for advice and guidance when planning 5G deployments.

But with more than one-third citing a system integrator as their preferred partner, CSPs are likely to run into some strong competition. Cost will be a critical factor, but CSPs should emphasize value rather than competing on price.

Next steps: To win market share, combine industry expertise with traditional CSP strengths in technical support and customer service.

1. Video monitoring and detection

Overview

5G-enabled video was the top-rated use case among enterprises, with 83% finding it appealing. That’s partly because 75% of the organizations surveyed are already using some form of video monitoring today – whether it’s monitoring premises, people coming and going, or operations.

Respondents can readily grasp the additional value that 5G can bring, with almost all citing the appeal of benefits such as high-quality and uninterrupted video streams, live mobile video capture, feeds from multiple video streams, and from where wi-fi is not available.

From monitoring to detection

While most organizations currently use video for basic monitoring, large organizations are much more likely to use advanced analytics for product quality or object detection. Companies already using advanced video analytics or using portable cameras are more likely to find 5G video surveillance appealing.

Energy and manufacturing are key targets, as their video surveillance needs go beyond monitoring. Manufacturing professionals understand how 5G can be leveraged to detect product defects, while energy professionals see the value of drone-mounted cameras to inspect plants and power lines.

Security: a new channel to market

While SMBs may invest in just one 5G video camera, larger businesses are likely to purchase 5G-enabled video monitoring and detection technology as part of a wider suite of security services.

This makes the security industry an attractive channel to market for CSPs, who could benefit from establishing partnerships with leading security providers.

Next steps

Emphasize detection and alerting applications for Energy and Manufacturing in particular, highlighting 5G’s ability to extend detection and alerting to remote and wire-free locations.

Educate security providers on the benefits of 5G video surveillance, with a view to forging partnerships.

Learn more about the video monitoring use case

2. Connected machinery

Overview

Organizations that already use robotics and connected machinery are most ready for 5G

Connected equipment and cloud-connected robotics are key enablers of Industry 4.0, in which manufacturing and other operations are highly automated and responsive to changes in demand.

Over three-quarters (77%) of respondents find this use case appealing, with companies that already use connected equipment showing the most interest in 5G.

Organizations that already use robotics and connected machinery are most ready for 5G

Connected equipment and cloud-connected robotics are key enablers of Industry 4.0, in which manufacturing and other operations are highly automated and responsive to changes in demand.

Over three-quarters (77%) of respondents find this use case appealing, with companies that already use connected equipment showing the most interest in 5G.

Companies that use connected equipment are readily able to visualize the benefits of 5G for real-time monitoring and remote control of machines they can’t currently control remotely.

Energy and manufacturing are the two key industry segments to target with this use case, with both reporting high use of connected machinery today.

The COVID-19 pandemic may accelerate interest as manufacturers’ explore remote control and robotic automation for their operations.

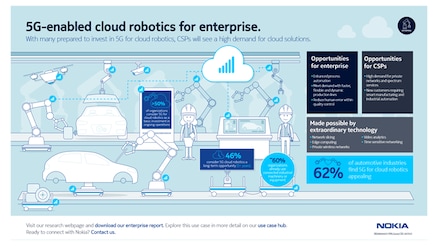

82% of respondents who already use cloud robotics today find the concept of 5G-enabled cloud robotics highly appealing.

Enhanced process automation was the key use case cited, with co-ordination of multiple robots ranking second.

The automotive industry, with its long history of robotics use, emerges as a key vertical sector that readily understands the additional benefits 5G can provide.

Target existing users of connected machinery and robotics and highlight the additional benefits that 5G can bring

Explore customers’ plans for automation and remote control in the wake of COVID-19, and show how 5G can support them

Learn more about the connected machinery use case

3. Fixed Wireless Access

Overview

An appealing alternative to wired broadband for SMBs

Fixed wireless access emerged from our survey as a strong near-term opportunity with small and midsize businesses.

73% of SMBs surveyed find 5G FWA appealing as an alternative or back-up to wired broadband, as long as it can perform as well or better than wired options.

An appealing alternative to wired broadband for SMBs

Fixed wireless access emerged from our survey as a strong near-term opportunity with small and midsize businesses.

73% of SMBs surveyed find 5G FWA appealing as an alternative or back-up to wired broadband, as long as it can perform as well or better than wired options.

SMBs are interested in 5G FWA should cost and performance be at parity with wired options; and remarkably many medium-sized businesses even indicate a willingness to pay more for 5G FWA.

Attractions include 5G’s speed and capacity, but also the comparative ease and speed of installation, as well as the possibility of bundling business mobile and business broadband into one plan.

Encouragingly for CSPs, we found that most SMBs would prefer to get FWA from a mobile provider. However, 40% said they’d be open to receiving it from a tech giant like Google or Amazon, with others citing TV, utilities and security systems providers.

To compete, CSPs should emphasize strengths like expert support and an existing technical field force. Alternatively, other providers may present MVNO partnership opportunities.

Emphasize performance parity and ease of install to convince SMBs of the benefits of 5G FWA over wired broadband

Explore MVNO partnerships with tech giants, utilities and security systems providers to maximize market share

Emphasize technical support and customer service capabilities to win against non-traditional communications providers

Learn more about the Fixed Wireless Access use case

4. Connected vehicles

Overview

Existing connected vehicle users are the key market for 5G-enabled vehicles

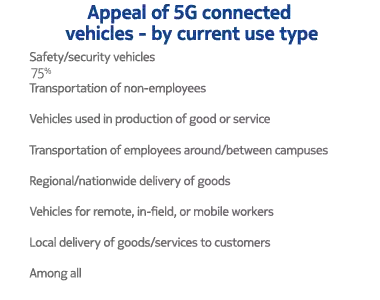

Of organizations that use vehicles, 74% find 5G appealing, but the level of appeal varies depending on the way vehicles are used.

We found higher interest in 5G among organizations where the vehicle is being used for safety and security purposes and for transportation of non-employees.

Existing connected vehicle users are the key market for 5G-enabled vehicles

Of organizations that use vehicles, 74% find 5G appealing, but the level of appeal varies depending on the way vehicles are used.

We found higher interest in 5G among organizations where the vehicle is being used for safety and security purposes and for transportation of non-employees.

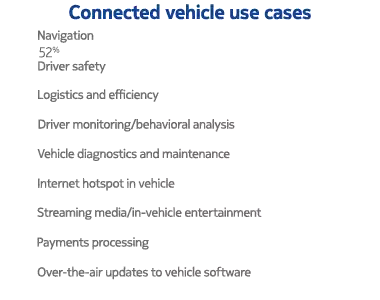

Organizations that already use connected vehicles are most interested in the enhancements 5G can bring. However, as many driver-assistance features can be used without 5G, CSPs will need to make a clear case for the 5G advantage.

Across industries, we found that 5G holds the most appeal where the vehicles are being used for safety and security purposes – such as monitoring premises and public safety – or for transporting paying customers.

Although it will require some education, the survey identified over-the-air updates as a potential key selling point for 5G-enabled vehicles.

5G connectivity enables in-vehicle systems to be updated remotely throughout the lifecycle of the vehicle, creating a potential new service revenue stream for automakers and dealers.

CSPs could leverage this opportunity to forge new partnerships in the automotive industry.

Segment campaigns by vehicle use type, targeting security vehicles and passenger transportation first

Emphasize the 5G difference for existing connected vehicle applications like navigation and safety alerts

Explore partnerships with OEMs and dealerships to deliver ongoing over-the-air updates to in-vehicle software

Learn more about the connected vehicles use case

5. Immersive experiences

Overview

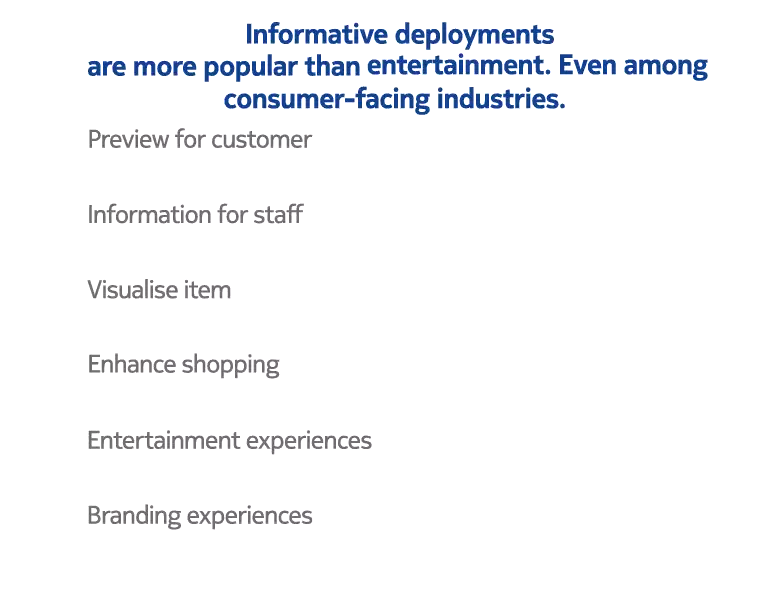

5G has the potential to catalyze more widespread industry adoption of Augmented reality (AR) and virtual reality (VR). Today, while 55% of organizations surveyed see the appeal of these immersive technologies, only half that number are actually using them.

5G’s ability to remove the data processing from the equipment could spur the production of cheaper and more lightweight headsets that can be used anywhere there’s 5G connectivity. That’s crucial because our survey shows there’s a strong grasp of the value AR and VR can bring, but adoption is currently lagging behind awareness.

5G has the potential to catalyze more widespread industry adoption of Augmented reality (AR) and virtual reality (VR). Today, while 55% of organizations surveyed see the appeal of these immersive technologies, only half that number are actually using them.

5G’s ability to remove the data processing from the equipment could spur the production of cheaper and more lightweight headsets that can be used anywhere there’s 5G connectivity. That’s crucial because our survey shows there’s a strong grasp of the value AR and VR can bring, but adoption is currently lagging behind awareness.

We uncovered high interest in the use of 5G-enabled AR and VR for informational applications - including training, safety, quality assurance, and retail sales support.

However, only one-fifth to one-third of respondents found the entertainment possibilities of 5G-enabled VR and AR appealing. Surprisingly, this was just as true in B2C verticals like media, advertising and retail as in B2B.

COVID-19: The catalyst for 5G-enabled AR and VR adoption?

The increase in remote working, home schooling and social isolation driven by the pandemic will almost certainly accelerate adoption as organizations look for new ways to operate remotely.

Companies of all kinds will be able to use immersive technologies to train and supervise employees, while retail businesses can use them to help consumers visualize what their purchases will look like. In the education field, AR and VR can help students to learn more effectively in a remote environment.

Emphasize informational use of VR and AR over entertainment-type applications

Highlight specific use cases like inspection, product installation and remote training/education

Learn more about the immersive experiences use case

The enterprise market for 5G: Conclusions and recommendations

The survey reveals significant near-term and medium-term opportunities for CSPs keen to move into the industry space and offer higher-value services that leverage 5G’s unique features.

Some key conclusions and recommendations from the enterprise 5G report include:

Industries are deploying 5G now. CSPs should develop well-crafted marketing and sales campaigns that outline the opportunity for individual sectors and organizations.

Video surveillance is the most popular use case overall. FWA for SMBs is another encouraging early opportunity, as it builds on CSPs’ existing services and expertise.

Energy and manufacturing are the most promising verticals. Premises security also promises interesting opportunities for sales and partnerships.

The competitive landscape is complex, especially in the large industry segment. Partnerships and vertical expertise will be key to success.

Get the full report

Get the complete inside track on what 1,000 IT decision-makers told us about their plans and goals for 5G, in our in-depth research report: Mapping Demand: Understanding the Enterprise 5G Opportunity for CSPs.

You’ll find:

Detailed quantitative analysis of business demand for five 5G use cases

Industry breakdowns for 7 key verticals across the public and private sectors

Qualitative insights from 15 in-depth phone interviews

Key takeaways and actionable insights you can use in your 5G marketing

Explore our infographics

Who we spoke to for this 5G industry report

Online survey

The data in this report is drawn from a survey of 1,000 IT decision makers in the US and UK across seven key industry sectors: energy, retail, manufacturing, government and public sector, automotive and transportation, media and advertising, and education.

Size: small business (1-49 employees), medium business (50-499 employees), large business (500+ employees)

Telephone interviews

To deepen our understanding of what 5G means for business, we conducted in-depth interviews with 15 current and potential 5G networking industry users and ecosystem players across target industry sectors.

Ready to talk to us?

Please complete the form below.

The form is loading, please wait...

Thank you. We have received your inquiry. Please continue browsing.